Many traders use a moving average crossover to indicate a point of momentum change. Long term investors may set their moving average indicators in long settings such as a 20MA crossing a 50MA. Swing traders or day traders may use shorter settings, such as 8 and 16.

Today I’d like to show you a really quick way to get set up in StockMonitor.com with your own moving average stock filter, and how to get an alert EVERY time it detects a stock.

You’ll also see in this example how to combine multiple indicators, or price levels, to create even better candidates for trading.

[2019 EDIT] Please note. Our platform has been fully redesigned inside since this post was written. All features still remain, but the layout and navigation is now improved.

Your First Filter Criteria

As I mentioned above, in this example I want to combine some price action to give me even better candidates for analysis. I like to measure increasing volume. If price is moving up, and volume is increasing, then it looks like people are buying into the move, and it’s not merely manipulation.

In place of volume, you may like to explore a break out of 10/20 day highs, or use other indicators.

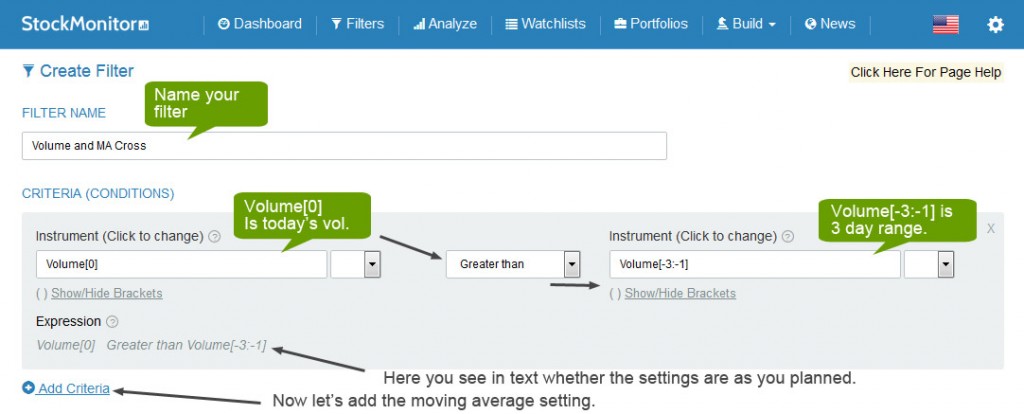

So first name your stock filter, so you can come back and edit it later. Then select volume by clicking on the instrument window and selecting from the list. In the instrument settings window I selected volume[0] which is today’s volume level. I selected “greater than” and in the 2nd instrument window I use a range of volume. Volume[-3:-1] is the level of volume over the previous 3 bars, candles, days etc. See below.

Each setting you change will be reflected in the expression text. This let’s you read in a logical way if your filter is making sense.

Click “Add Criteria” and move on to our moving average crossover settings.

Moving Average Crossover Criteria

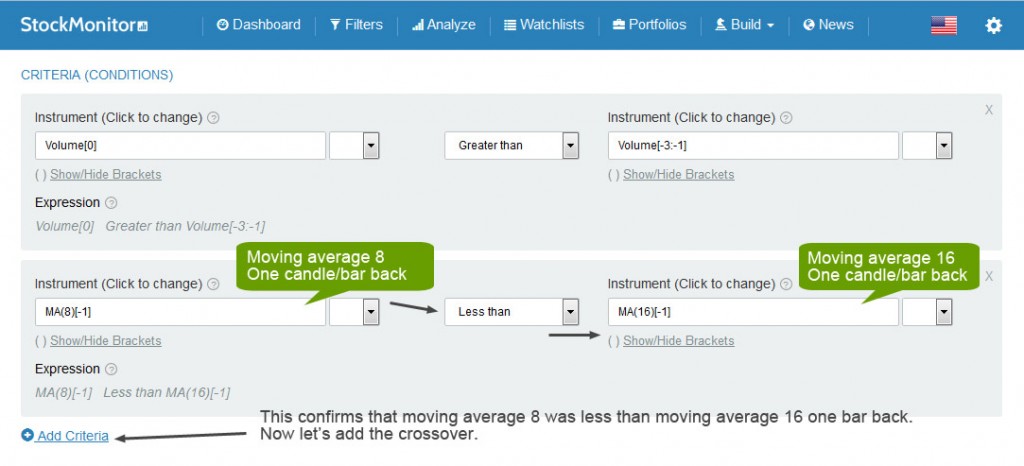

To build a filter that detects a crossover is really simple. The logic is, if an indicator in the current bar, is greater than the indicator in the previous bar, then it has moved up/crossed. So let us set that now.

Here you see I have added the MA8 is less than MA16 one bar/candle/period back from current bar. You set this with -1 in the offset box.

This detects that the moving average 8 was less than moving average 16 one period back from current bar.

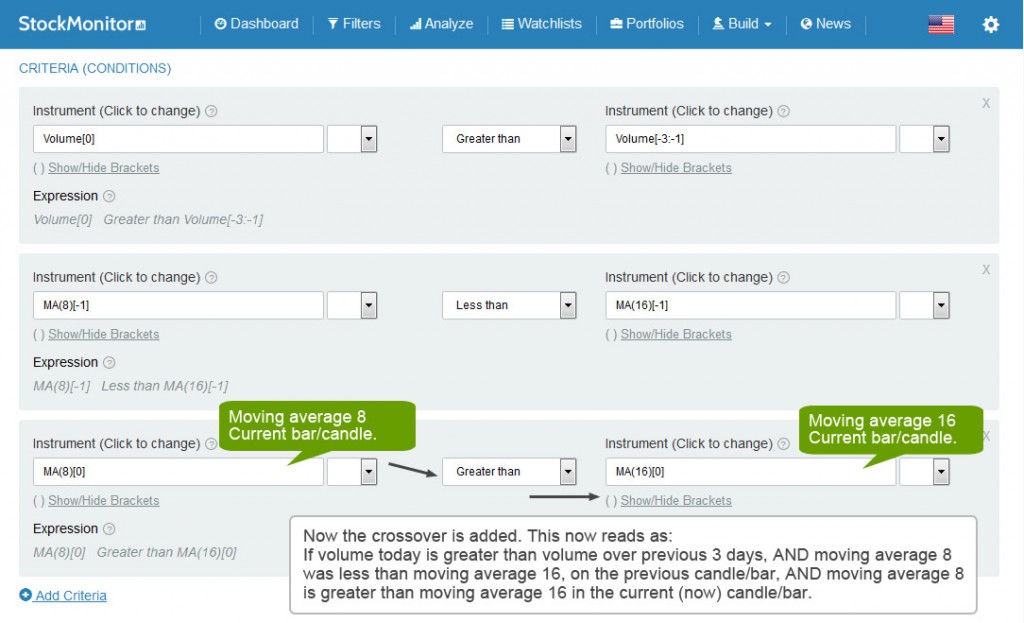

In the next criteria, set the moving average 8 to be greater than moving average 16 in current bar [0]. See example.

And that’s it!

On a technical analysis chart, this is what a 8 and 16 moving average crossover will look like.

You can now test your filter. Select an exchange, index or set of stocks from a watch list you created to run this filter on. In the table below you’ll see some current candidates for analysis.

Now, save your filter! This is important, or your settings will be lost.

Set An Alert For This Filter

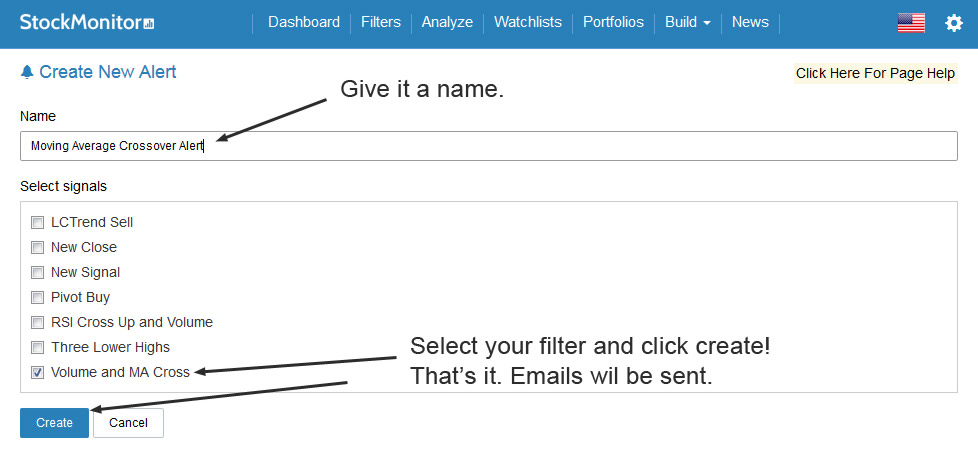

This is the easiest part. Simply click on “Build” in the main menu and select “Alert” from the drop down menu.

Give your alert a name, select from the list which filter to send alerts for, and click “Create”. That’s it. Now you will get emails every time a stock is detected by this filter. It’s useful to know that you can opt out of email alerts via the manage subscription link at the bottom of every email you receive.

It’s really quick and simple to build a filter for anything that moves in the market. Go have a play around. You may be surprised at some of the new stocks you detect.

Update: Inside our filter, we have now added pre-set filters to create a Golden Cross screener, and many other MA crossovers. You can edit each one easy to set it to your preferred moving average.