Teaching yourself how to find momentum stocks is a great exercise in stock picking. Momentum powers trends in the markets, trends power your profits. Identifying momentum stocks, at an early stage, gives you an excellent edge over people who are late to the party.

Momentum is usually defined by a trending move. However, a short impulse can also be said to qualify as momentum. Let me explain the two and how they have different characteristics.

1 Trending Momentum.

The main way to find momentum stocks is this. Usually a trader is looking for a series of higher highs, and lower lows. This is what is “normally” suggested a trend should look like. It’s correct in a perfect market that it may be easy to spot, but in a volatile market, lows and highs can be more sporadic.

In a volatile market the price can break beyond the last high and retrace to test a support before moving onward again, it may do this several times. But at the end of the day, the stock will gather more momentum with the market, and eventually will break out to new levels.

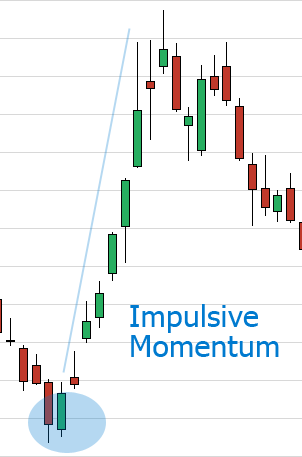

2 Impulsive Momentum.

An impulsive move is a sharp upward move, with no time to turn back. Usually they are created by a news event at a company, in the market, or with speculation. These types of momentum stocks tend to retrace a lot after the spike has ran out of steam. Often as buyers have all sold out, leaving the last to the party holding the loss.

Be careful with impulsive moves, if that’s what floats your boat.

Whichever type interests you, here is a way to find momentum stocks, as the move begins by using the filter inside StockMonitor.

Find Momentum Stocks

First, many momentum moves in stocks begin with an event of sorts. An event usually means increased volume activity.

Using the filter, check out the box titled “Volume”. Inside, test out some of the filters that detect stocks with Volume up X from the 30 Candle Average.

If volume burst up above a 30 day average, take a look in at the technical chart by clicking the icon on each result. You will see a news feed next to each chart, maybe there’s a reason for the move?

Add some of these stocks into a watch list titled momentum plays.

Now, after a few times doing this, you will have a decent watch list of stocks. Now you can use the filters “Momentum Rising over 3 Period” or 5 periods even.

If the stocks that you are watching have begun a new trend, at some point momentum indicator would have started to rise. If it was rising before the unusual volume increase then it could have been gathering strength in anticipation of a news event. Track these stock prices over the coming days, and see how they behave.

Are they rising? Holding above a previous low? Breaking out to new highs?

Price will tell you a story, and you will soon become aware of the movements that signal the start of new trends to jump on.